[ad_1]

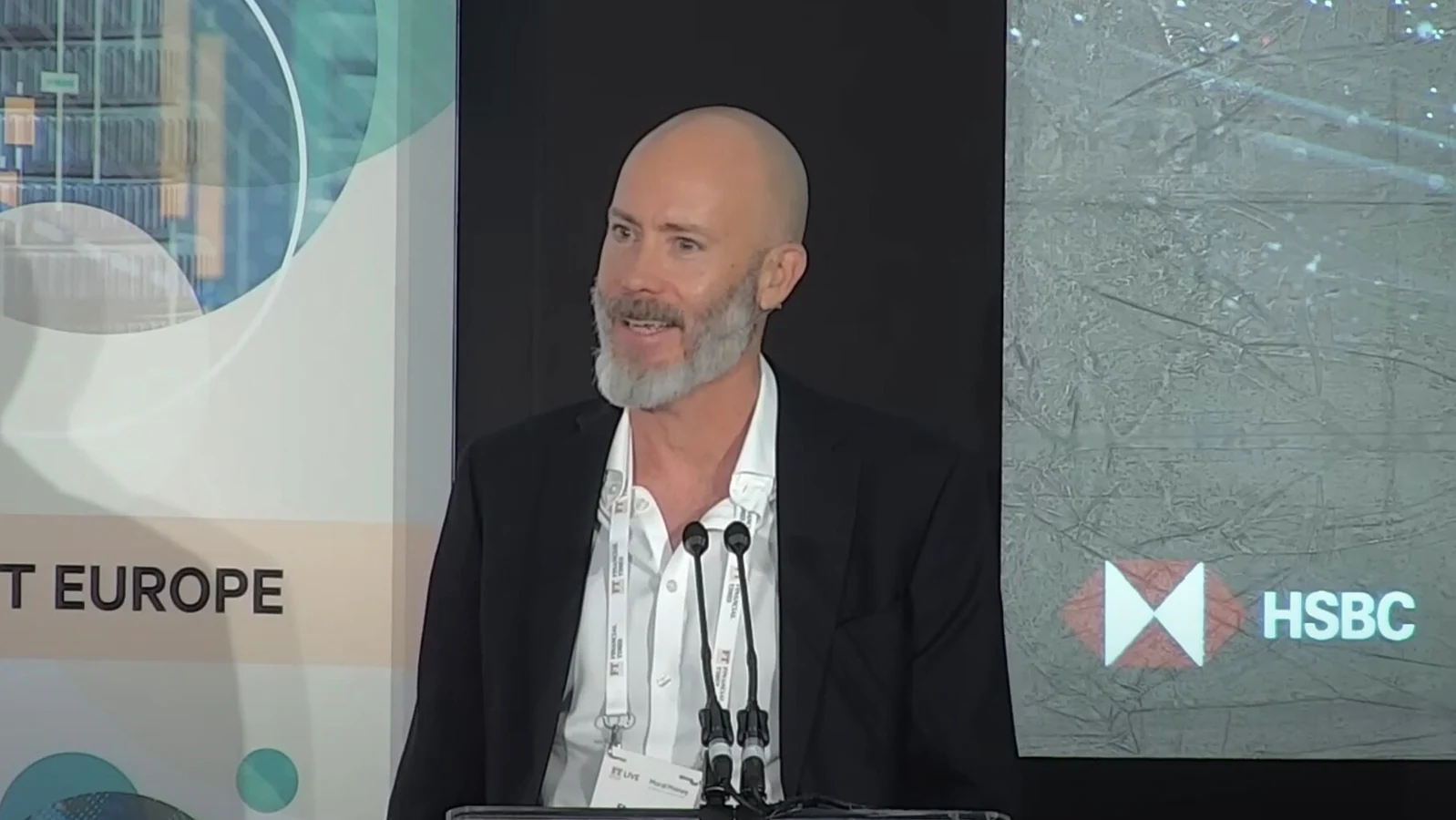

After drawing both cheers and rebukes from within the finance industry, HSBC Asset Management’s suspended head of responsible investing has now caught the attention of academia.

A presentation delivered by Stuart Kirk earlier this month offered “spurious correlations,” as well as “weak methods” and an “even weaker” grasp of financial theory, according to Noel Amenc, a PhD and associate professor at EDHEC Business School, and Frederik Blanc-Brude, a PhD and director at EDHEC Infrastructure Institute.

In an open letter dated May 26 and addressed to Kirk, the two picked apart a now infamous series of remarks he made at a Financial Times event earlier this month. Their concern, they wrote, was that Kirk represents a new kind of “interlocutor,” namely someone who clearly believes in climate change but does “not care.” Their goal, they said, is to ensure a “minimum amount of theoretical and empirical consistency” in the ongoing debate around sustainable investing.

Also read: Banks to stay shut for 8 days in June 2022: See full list of holidays

Kirk, whose presentation has since been disavowed by his employer, used his appearance at the FT event to bemoan the regularity with which “some nut job” has told him to worry about existential threats such as climate change. He criticized regulators and central bankers for caring too much about global warming, and appeared to draw comfort from the fact that stock markets would continue to go up even if rising sea levels left major cities under water.

The comments fed into an already heated debate that’s ripped through the environmental, social and governance investment world this year. Some financial professionals turned to social media to cheer Kirk for saying out loud what they said many are thinking. Others expressed shock that such a senior member of the financial establishment could dismiss the risks posed by climate change. And HSBC clients will doubtless be wondering what Kirk’s comments mean for their ESG investments.

One of Kirk’s key points was to suggest that markets’ failure to price in a climate catastrophe implied that such a scenario was unlikely.

“This is a false equivalence,” Amenc and Blanc-Brude wrote. “Markets are indeed efficient, but only at transforming all the information available today into prices.”

Also read: DHFL-Yes Bank case: CBI arrests businessman Avinash Bhosale

The two cited a yet-to-be published EDHEC survey of reasons given by asset owners and asset managers around their need for non-financial data. “Risk management” was the most common explanation, “well ahead” of regulatory pressure and stakeholder management, they said.

“The need to measure climate risk better and to integrate it into the investment decision is the very reason why investors have been increasingly demanding access to non-financial data on climate risk,” they said. “If climate risks were known, they would be priced and could indeed be managed from the comfort of a Bloomberg terminal. But this is not the case today and may not even be the case tomorrow.”

[ad_2]

Source link