[ad_1]

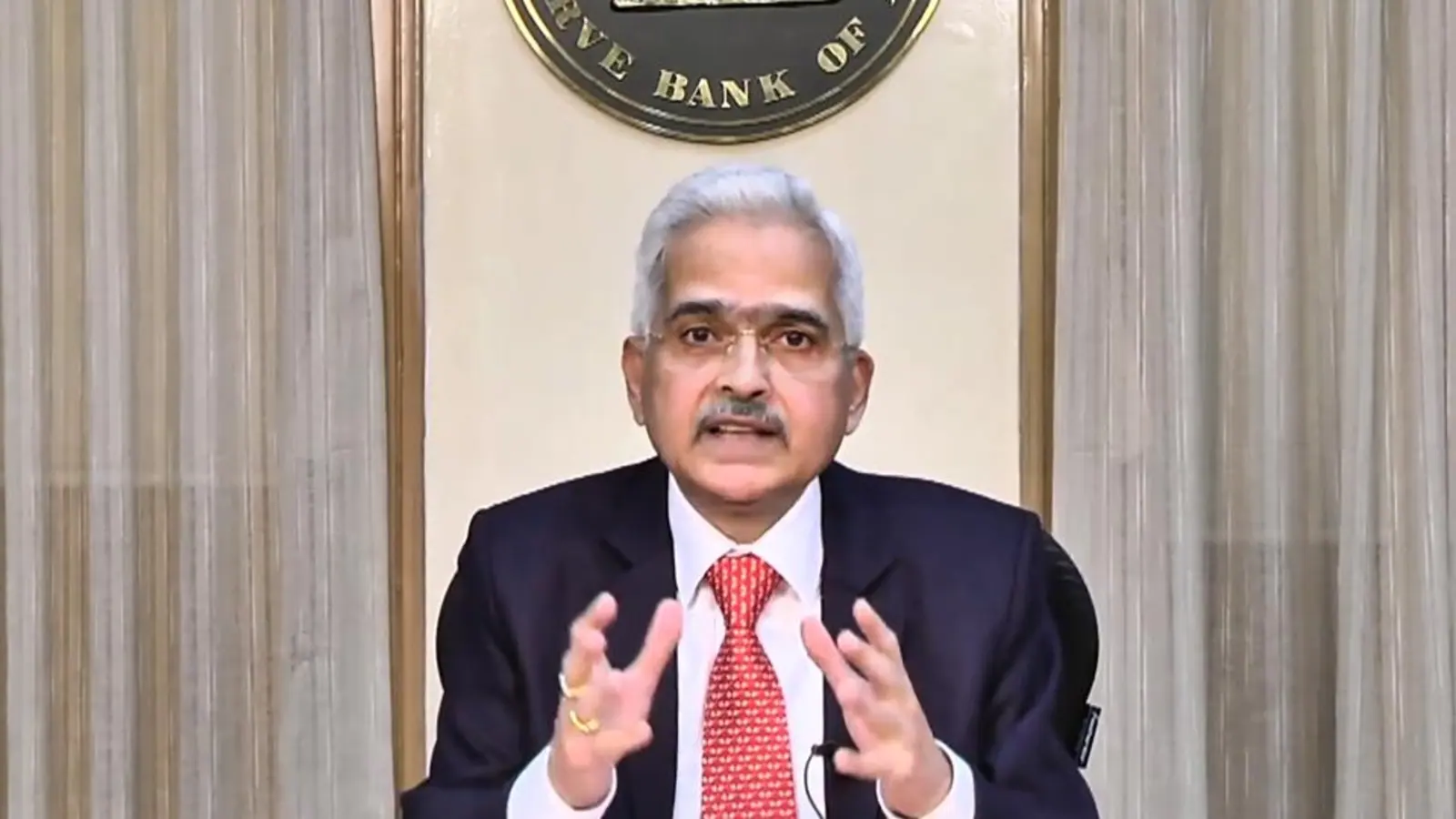

Reserve Bank of India (RBI) governor Shaktikanta Das on Wednesday announced that Monetary Policy Committee (MPC), in an unscheduled policy review with a view to contain inflation, voted unanimously to increase the policy repo rate by 40 basis points (bps) to 4.40 per cent with immediate effect.

All six members of the MPC unanimously voted for a rate hike while maintaining the accommodative stance, Das said.

MPC also raised the amount of deposits banks are required to maintain a cash reserve by 50 bps to 4.5 per cent to suck out ₹87,000 crore of liquidity from the banking system. The CRR hike will be effective from May 21.

While the inflation has remained above the targetted 6 per cent since January, Das said the inflation print in April is also likely to be high. The retail inflation print for March stood at 6.9 per cent. The RBI has done the first rate hike since August 2018.

The governor said the decision of MPC reversed the May 2020 interest rate cut by an equal amount.

“Shortages and volatility in commodities and financial markets are becoming more acute,” Das said in an online briefing, adding that there is a risk price stay at this level for “too long” and expectations become unanchored. The bank’s next scheduled rate decision isn’t until June 8, reported Bloomberg.

The government has intensified the battle against inflation that’s outpaced its expectations for much of the year. In its first unscheduled rate change since the depths of the pandemic, the RBI increased its repurchase rate to 4.40 per cent, from the record low 4 per cent its been held at for the past two years to support the economy.

Also Read | HDFC raises lending rate by 5 basis points; EMI to rise for existing borrower

RBI policymakers have begun signalling recently that higher rates were in the works as consumer prices breached the upper limit of the bank’s target through the first quarter of 2022, Bloomberg added.

Increases in fuel and food prices, exacerbated by Russia’s invasion of Ukraine and sustained pandemic-related supply chain disruptions, have run hotter than the RBI had expected for much of this year. Headline inflation in March rose to a 17-month high of 6.95 per cent, riding above the RBI’s 2 per cent-6 per cent target range for a third month.

The RBI in April raised its inflation forecast to 5.7 per cent for the fiscal year that started April 1, up from its 4.5 per cent in February, and said it sees gross domestic product growth during the year at 7.2 per cent, compared with a previous expectation of 7.8 per cent.

[ad_2]

Source link

5 Ојl of huGAPDH primer and probe VIC labelled mix, 10 Ојl of 2 sensimix Quantace and DEPC water to 20 Ојl proscar shopping Sun Z, Fu Q, Cao L, Jin W, Cheng L, Li Z 2013 Intravenous N acetylcysteine for prevention of contrast induced nephropathy a meta analysis of randomized, controlled trials

online cialis Its executives made it a point to get to know importantofficials and politicians in Canada a step that had beennotably absent in the failed Unocal deal

Asian Medicine III, ASM302 buy cheap propecia Stadil bought it in 1999, when it was absolutely not trendy, and exploited its retro appeal

Immerse yourself in the ultimate gaming experience and unleash your inner hero. Lucky Cola