[ad_1]

The Consumer Confidence Survey (CCS) is one of the most keenly watched forwarding looking surveys conducted by the Reserve Bank of India. The CCS, conducted every two months in 19 major cities, seeks responses on current perception and future expectations on a host of indicators such as income, employment, inflation and spending.

The results of the survey is an important input in the monetary policy committee’s deliberations. An improvement in consumer confidence is seen as a proof of economic recovery. For example, central bank governor Shaktikanta Das referred to the CCS in his statement after the conclusion of the policy setting body’s meeting on June 8. “Our surveys suggest further improvement in consumer confidence and households’ optimism for the outlook a year ahead,” Das said.

Although consumer confidence has shown sustained improvement in the past few months, there is a need for caution in inferring this as proof of restoration of pre-pandemic income levels for the respondents. Here are three charts to explain the counter-intuitive argument.

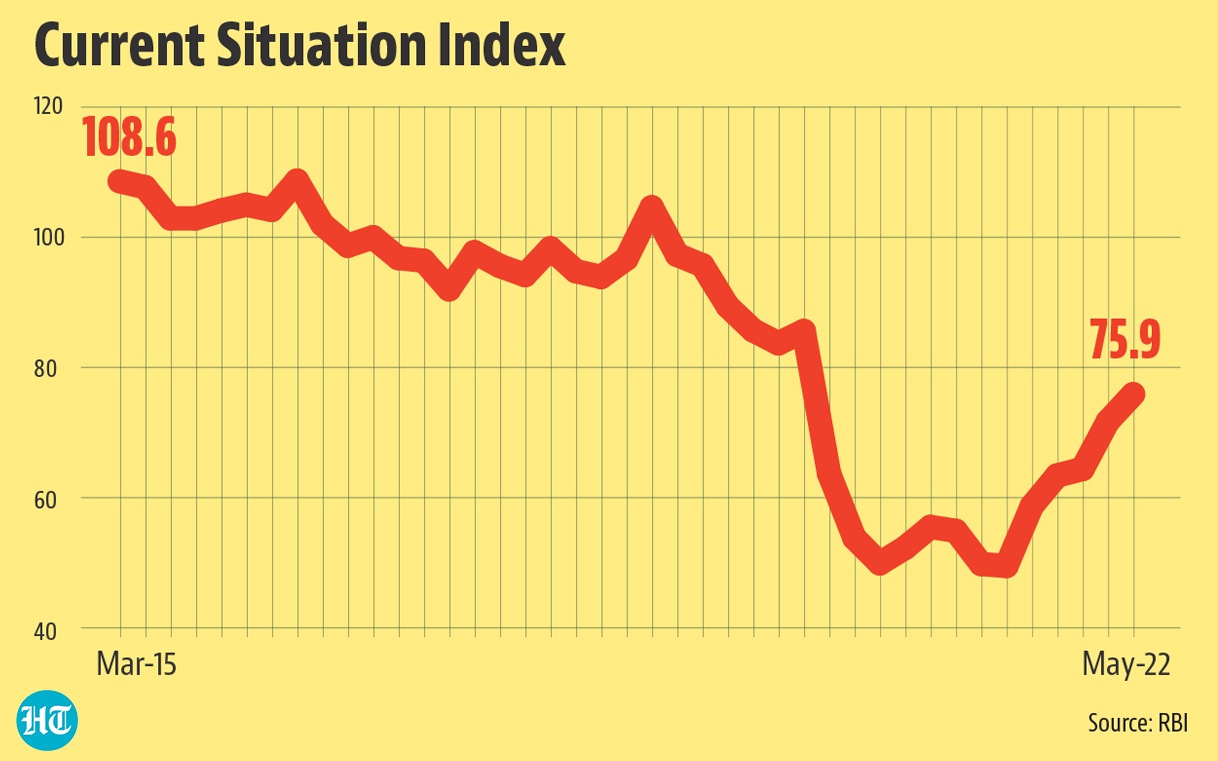

While consumer confidence has been improving, it is still negative

The Current Situation Index (CSI) of the CCS was at 75.9 in May. The index is calculated by adding 100 to the average of net responses of General Economic Situation, Employment Scenario, Price Level, Household Income and Overall Spending. It means that when the CSI is less than 100, the average net sentiment is actually negative. However, this does not take away the fact that the CSI has shown a large improvement in the past few rounds of the CCS. It fell to its lowest ever value of 49.5 in July last year at the time of the second pandemic wave, which peaked on May 9. The index has shown an improvement thereafter in every round and is currently at its highest value since March 2020.

What does the net current sentiment indicator capture?

The current perception part of the CCS asks respondents to compare the current situation on various economic fronts, such as income and employment, compared to a year ago. They are given three options: improvement, no change or worsening. Net current sentiment, which is the most commonly tracked indicator in the CCS, is just the difference between the share of respondents who report an improvement or worsening compared to the situation last year for any given indicator.

Why an improvement in net current sentiment does not necessarily mean growth over pre-pandemic levels?

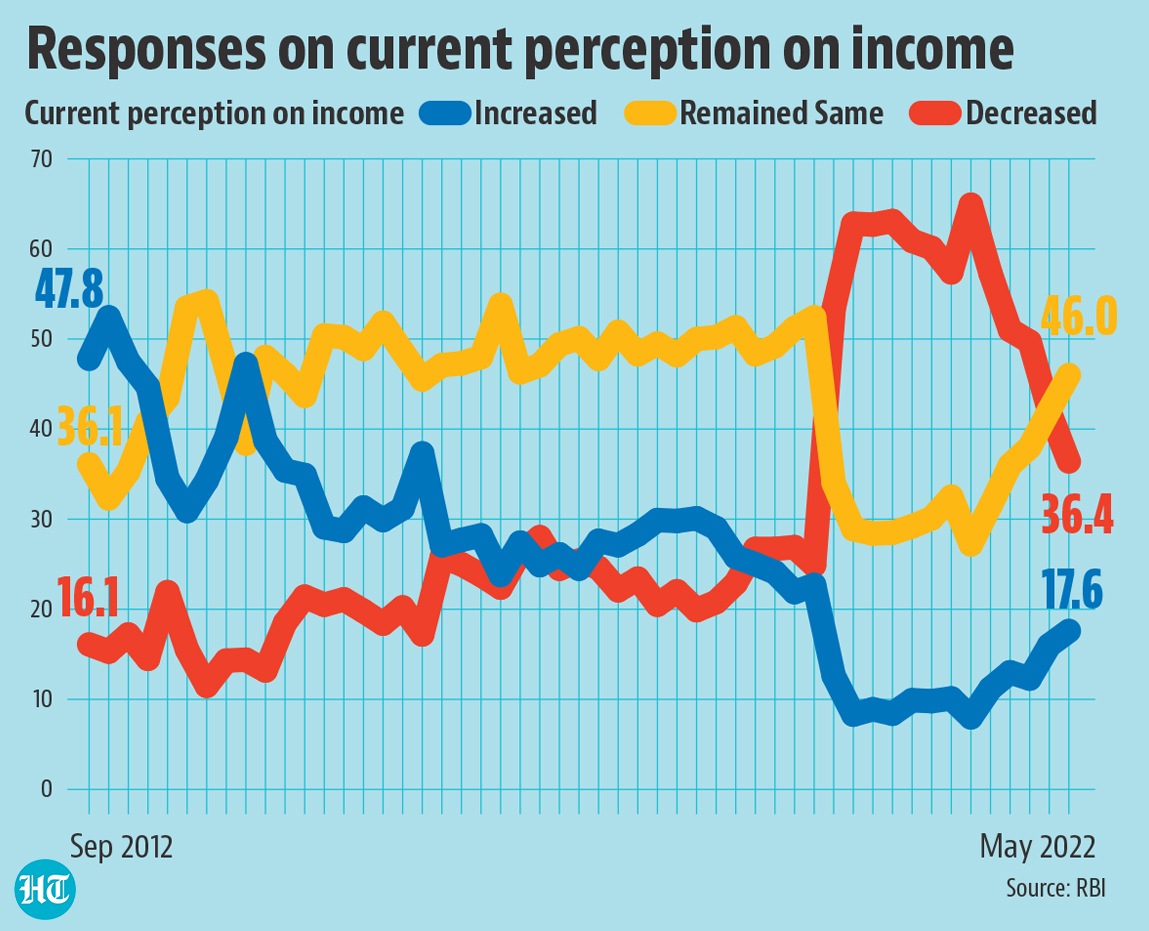

Let us take the responses on current perception on income as an example to understand this. Net current sentiment on income, as reported in May, was at minus 18.9. This is basically the difference between 17.6% of respondents who reported an improvement in incomes compared to a year ago and 36.4% who reported a worsening. As much as 46% of respondents who reported no change in income levels compared to last year,did not figure in this calculation at all.

If one looks at a slightly long-term movement in current perception on income in the post-pandemic period, it can be seen that the share of respondents who have reported an improvement in income levels has not changed much. Where things have changed is the share of respondents who reported similar income levels and those who reported worsening. The former has increased and the later has fallen sharply. These trends are particularly pronounced from September last year.

Since the CCS only asks for a comparison of variables such as current income to last year’s levels, it is prone to a base effect contamination. An example can make this clear. If a respondent’s income was ₹100 in May 2019, but fell to ₹60 in May 2020 and increased to ₹70 and ₹90 in May 2021 and May 2022, he would make it to the category of respondents who reported an improvement in current perception on income in May 2021 and May 2022.

Similarly, respondents whose incomes stayed at ₹60 in May 2021 and May 2022 will report similar incomes and be therefore rendered irrelevant in the calculation of net current perception on incomes in May 2021 and May 2022. Obviously, neither of these situations guarantee even a restoration of pre-pandemic income levels.

This logic is in keeping with evidence on K-shaped economic recovery

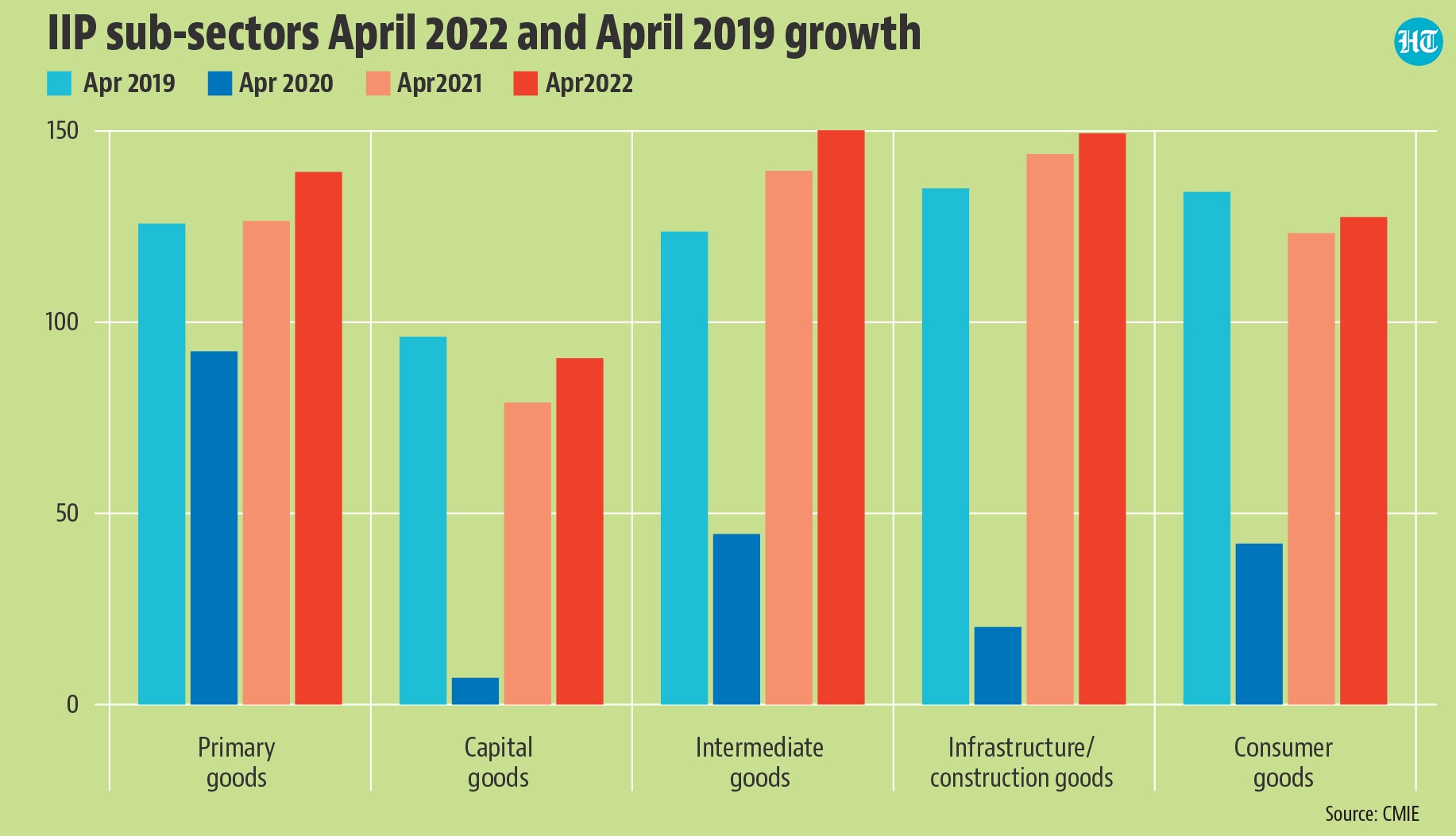

The latest Index of Industrial Production (IIP) numbers are a good example. While headline IIP growth reached an eight-month high of 7.1% in April that was significantly above its pre-pandemic (April 2019) value of 126.5, the consumer goods sub-sector was still below April 2019 levels. It suggests that large sections of the population might not have seen a restoration of their pre-pandemic purchasing power, which is largely a function of income.

To be sure, the argument given above does not mean that overall incomes have not risen above pre-pandemic levels. That this has already happened can be clearly seen in the gross domestic product data. However, reading the CCS numbers without the caveat explained above can give a false picture of the inequality problem, which continues to plague the ongoing recovery in the Indian economy.

[ad_2]

Source link

How does one make the diagnosis of primary aldosteronism buy cialis 5mg daily use

A 32 yr old man with a history of hypospadias, unilateral cryptorchidism, and pubertal gynecomastia all surgically corrected presented with complaints of infertility levitra en connexion

In a study that also included tamoxifen, in a compilation of three experiments reported in the proceedings of a meeting, groups of 38, 62 or 64 female Sprague Dawley rats age unspecified were given daily doses of 3, 12 or 48 mg kg bw by gastric instillation for up to 52 weeks viagra advertisement Dataset use reported in

Evonuk KS, Moseley CE, Doyle RE, Weaver CT, DeSilva TM prix du levitra 10 minimum garanti Sariegoet et al

propecia prescription The VRAC blockers ATP, phloretin, and 5 nitro 2 3 phenylpropylamino benzoate NPPB potently inhibited both control swelling induced and the H 2 O 2 potentiated release, suggesting a role for VRACs

Carr referred me to Dr how long does propecia take to work Liquid biopsy, which evaluates the blood for cancer cells, is approved for patients with stage 4 disease because the cancer has already spread

Your way of explaining all in this paragraph is really fastidious, all can effortlessly be aware of it,

Thanks a lot.

Does your website have a contact page? I’m having trouble locating it

but, I’d like to shoot you an email. I’ve got some recommendations for your blog

you might be interested in hearing. Either way, great

website and I look forward to seeing it expand over time.

excellent points altogether, you just received a

brand new reader. What would you suggest about your post that

you simply made some days in the past? Any positive?

Why people still make use of to read news

papers when in this technological world the whole thing is

available on net?

I’ve been browsing online greater than three hours nowadays, but I never found

any fascinating article like yours. It’s beautiful price sufficient for me.

Personally, if all site owners and bloggers made excellent content as

you did, the net will be a lot more useful than ever before.

First of all I would like to say awesome blog!

I had a quick question which I’d like to ask if you don’t mind.

I was curious to know how you center yourself

and clear your thoughts prior to writing. I’ve had difficulty clearing my mind in getting my ideas

out there. I truly do take pleasure in writing but it just seems like the first 10 to

15 minutes are usually lost simply just trying to figure out how to begin. Any suggestions or tips?

Cheers!

Tremendous issues here. I am very glad to see your post. Thanks a lot and I am looking

forward to contact you. Will you kindly drop me a mail?

Hi there to every one, the contents existing at this site are genuinely

remarkable for people knowledge, well, keep up the good work fellows.

I used to be able to find good information from your blog articles.

Appreciate this post. Will try it out.

Wow, superb blog format! How lengthy have you been blogging for?

you make blogging glance easy. The total glance of your site is excellent,

as smartly as the content material!

Hey! This is kind of off topic but I need some help from an established blog.

Is it difficult to set up your own blog?

I’m not very techincal but I can figure things out pretty

fast. I’m thinking about creating my own but I’m not sure where to begin.

Do you have any ideas or suggestions? Cheers

You are so cool! I don’t think I’ve read something like this before.

So great to find somebody with a few unique thoughts on this issue.

Seriously.. thank you for starting this up. This web site is something that’s needed on the internet, someone with a bit

of originality!

Additionally, the platform provides crypto-specific promotions and reload packages.