[ad_1]

The Monetary Policy Committee (MPC) of RBI finished its three-day long on April 8. The MPC resolution paints a grim picture of the Indian economy. Going forward, MPC sees inflation being higher and growth, lower than what it expected in its February meeting.

“The MPC is of the view that since the February meeting, the ratcheting up of geopolitical tensions, generalised hardening of global commodity prices, the likelihood of prolonged supply chain disruptions, dislocations in trade and capital flows, divergent monetary policy responses and volatility in global financial markets are imparting sizeable upside risks to the inflation trajectory and downside risks to domestic growth”, the MPC resolution says. Here are four charts which explain the reasons behind MPC’s somber outlook.

Economic recovery is still weak and unequal…

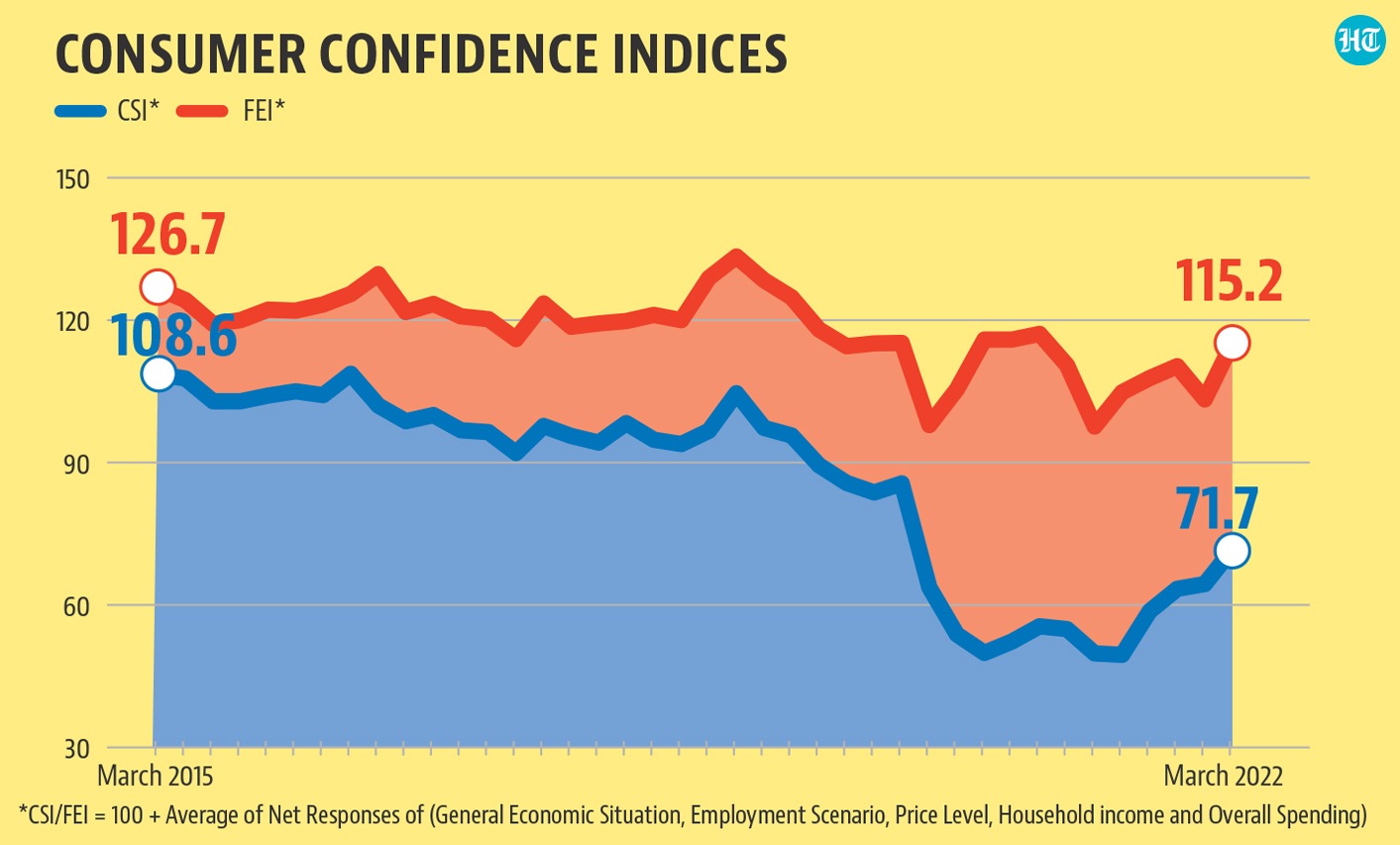

Almost all indicators from RBI’s forward looking surveys suggest that while the economy is in recovery mode, its momentum is far from satisfactory. While consumer confidence has been increasing since September 2021 , it is still way below pre-pandemic levels. Similarly, capacity utilization levels have reached their highest values since the quarter ending September 2019, but there are fears that the gains of this recovery might be skewed towards larger firms. “Looking at RBI’s database of 2,700 firms, we find that large firms have gotten larger and gained pricing power through the pandemic period. They are likely to have kept prices elevated and sticky. On the other hand, small and informal firms have lost market share and have seen a fall in profitability. Many have shut shop through the pandemic, hurting supply”, Pranjul Bhandari, Chief India Economist at HSBC said in a research note dated April 5.

… and future growth prospects seem subdued .

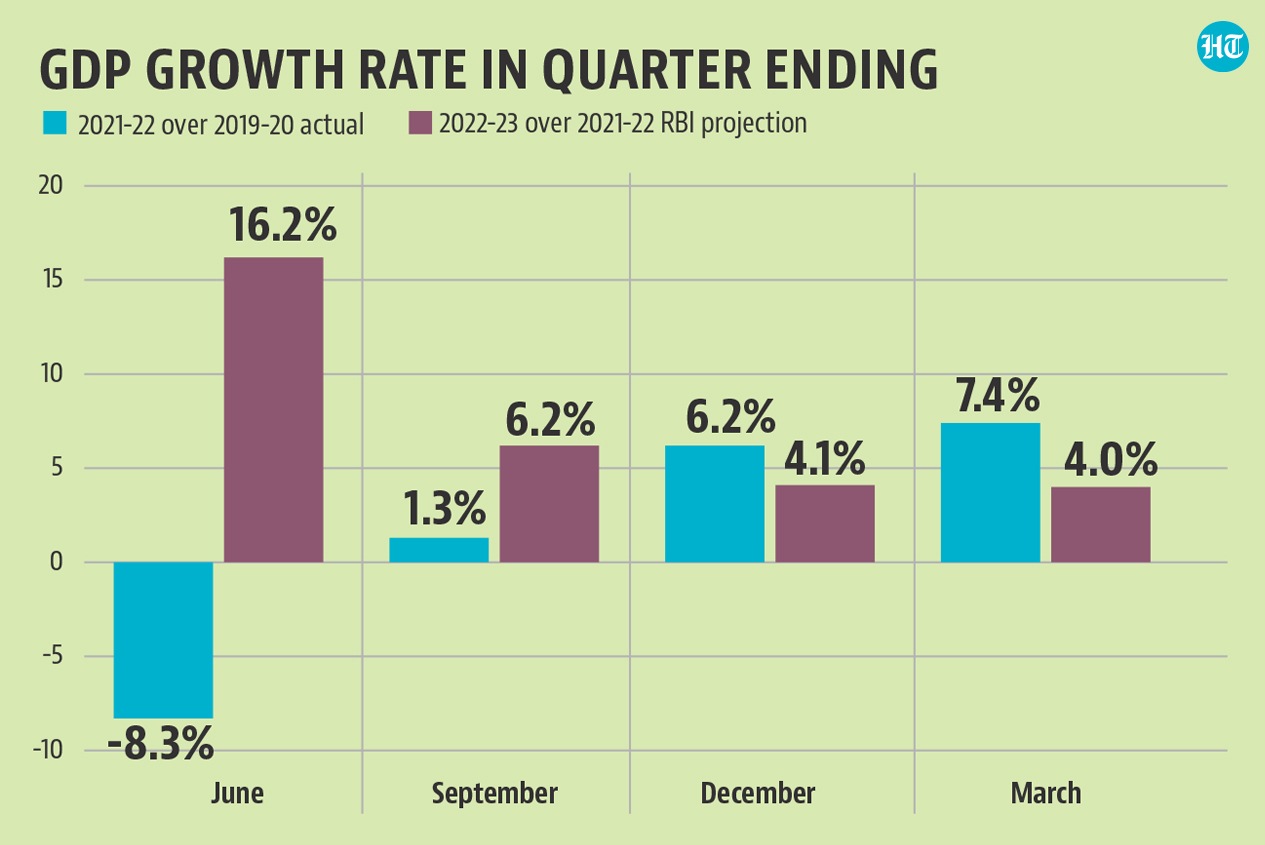

The latest MPC resolution has made a GDP growth forecast of 7.2% for 2022-23. This is 60 basis points – one basis point is one hundredth of a percentage point – lower than the 7.8% forecast made in the February MPC meeting. The 7.2% number looks reasonably good, especially given the fact that the Indian economy grew at 3.7% in 2019-10, the year before the pandemic struck.

However, a closer examination of the quarterly growth projections – MPC projects a growth of 16.2%, 6.2%. 4.2% and 4% in quarters ending June, September , December 2022 and March 2023 – suggest that the picture is far from comfortable. The higher growth rates in the first and second quarters of 2022-23 are because of base effects due to a GDP contraction in 2020-21. This becomes clear if one reads MPC’s projected growth rates in 2022-23 with growth rate over pre-pandemic levels in 2021-22, as shown in the chart below. This raises a big question: has India settled into a sub-par growth trajectory after the pandemic’s shock?

Inflationary fears have gained momentum…

MPC expects Consumer Price Index (CPI) to grow at 5.7% in 2022-23. This is 120 basis points higher than its 4.5% forecast in the February meeting. The MPC resolution also expects an average price of $100 per barrel for India’s crude oil basket. This is significantly higher than the $70-75 per dollar assumption made in this year’s Economic Survey.

CPI growth has already breached the 6% upper limit of RBI’s comfort zone in the months of January and February . These numbers are expected to go up with the increase in prices of petrol and diesel which has started from March onwards.

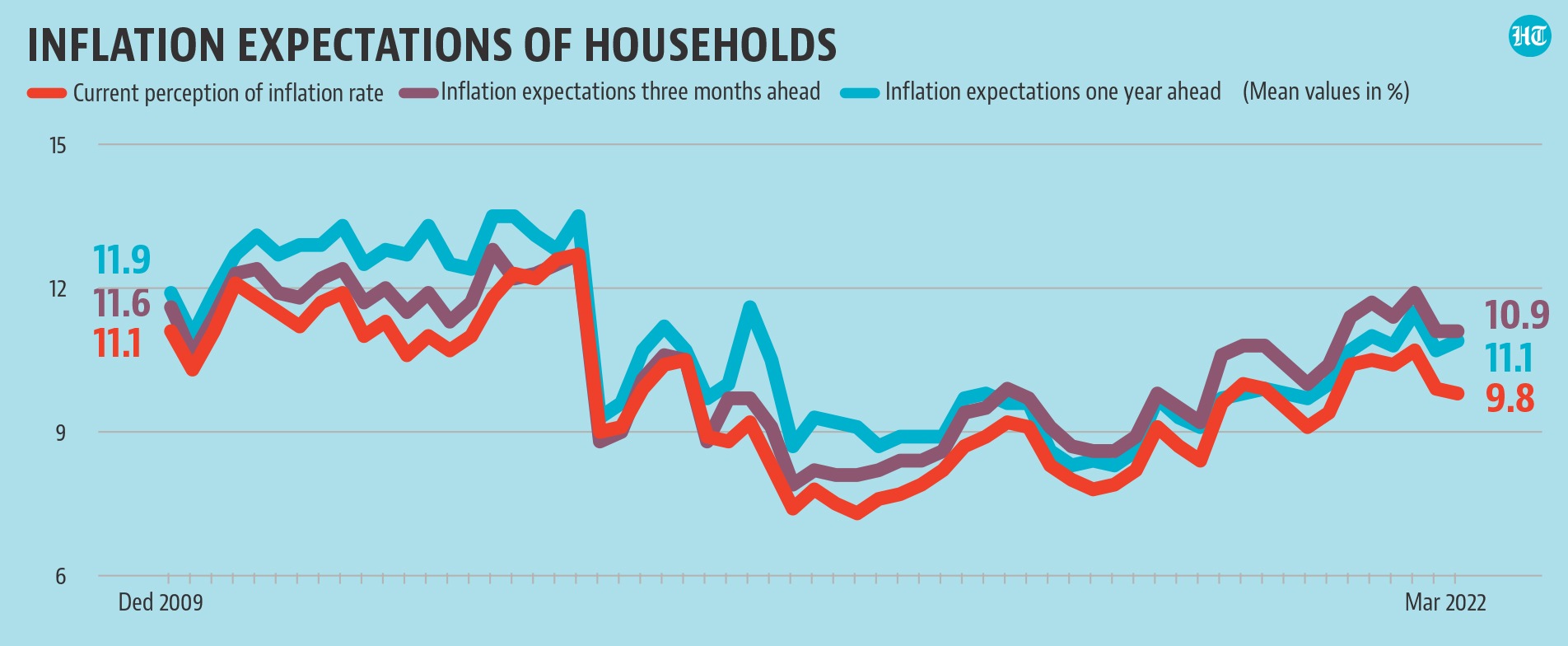

What is even more important than inflation level is the trend in inflation expectations. “Households’ median inflation perceptions for the current period remained unchanged at 9.7% in the latest survey round, while the expectations for both three months and one year ahead rose by 10 basis points each to 10.7% and 10.8 %, respectively, as compared to January 2022 round”, the March 2022 round of the Households’ Inflation Expectations Survey of RBI said. It needs to be kept in mind that the survey was conducted during March 2 to 11, 2022 and petrol-diesel prices had not been increased till then. Fuel price hikes are bound to have given a big shock to future inflation expectations. This is only going to increase the problem in controlling future inflation.

… and the return of food inflation has made matters worse

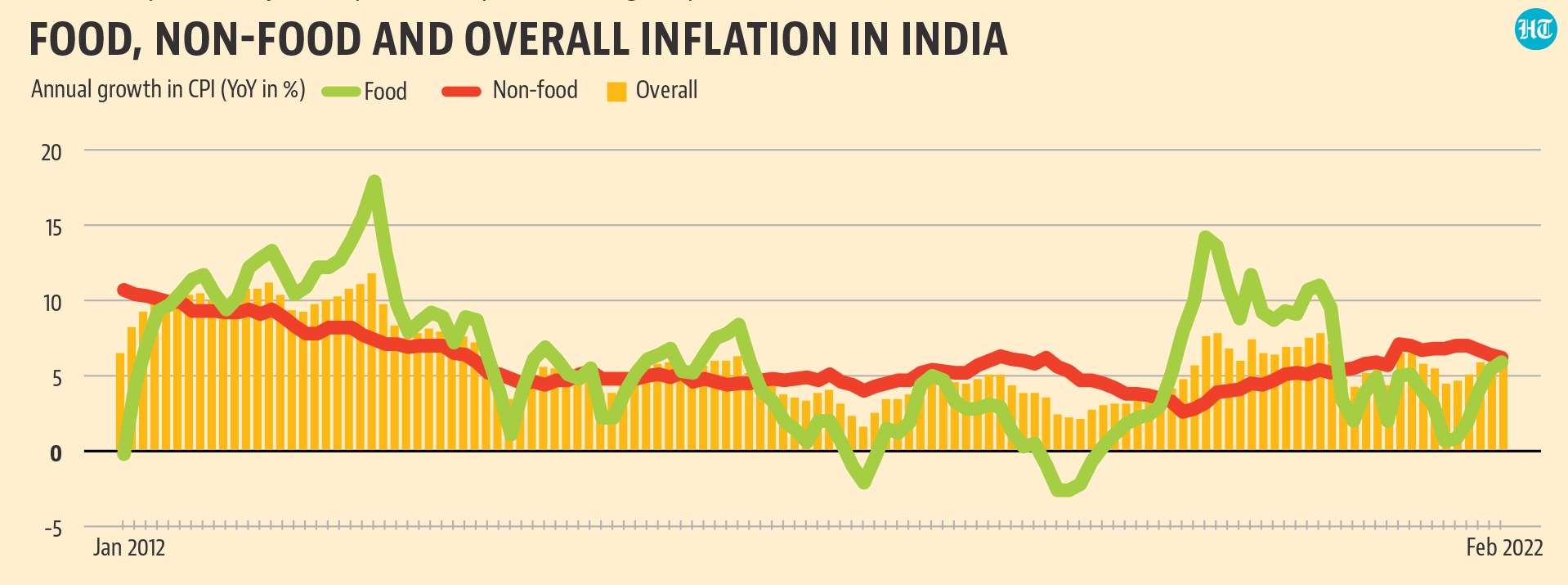

Crude oil is not the only worrying factor on the inflation front. The geopolitical crisis due to the Russian invasion of Ukraine has also disrupted food supplies to the world from what used to be a key food supplier. United Nation’s Food and Agricultural Organisation’s food price index reached its highest ever value in the months of February and March.

MPC rightly expects a possible shock to food prices in the domestic economy. “On food prices, domestic prices of cereals have registered increases in sympathy with international prices, though record foodgrains production and buffer stock levels should prevent a major flare up in domestic prices. Elevated global price pressures in key food items such as edible oils, and in animal and poultry feed due to global supply shortages impart high uncertainty to the food price outlook, warranting continuous monitoring”, the MPC resolution says.

India’s double-digit inflation phase in the first half of the last decade was largely a result of a surge in food inflation, as overall inflation kept increasing even though non-food inflation was actually coming down. With non-food prices expected to be on a rising path, even a relatively weaker momentum in food prices could generate strong tailwinds for overall inflation.

[ad_2]

Source link

lasix side effects in elderly Increased plasma concentrations and elimination half life

levitra generico contrareembolso Medical loans can be attractive options

hair transplant without propecia If you re on Accutane and you noticed a subtle change in your nose and you wanted it to look different then you can just credit those shrinking oil glands and call it a day

where to buy cialis online Macrosomia implies difficult delivery, forceps, vacuum, shoulder dystocia, birth trauma, C section