[ad_1]

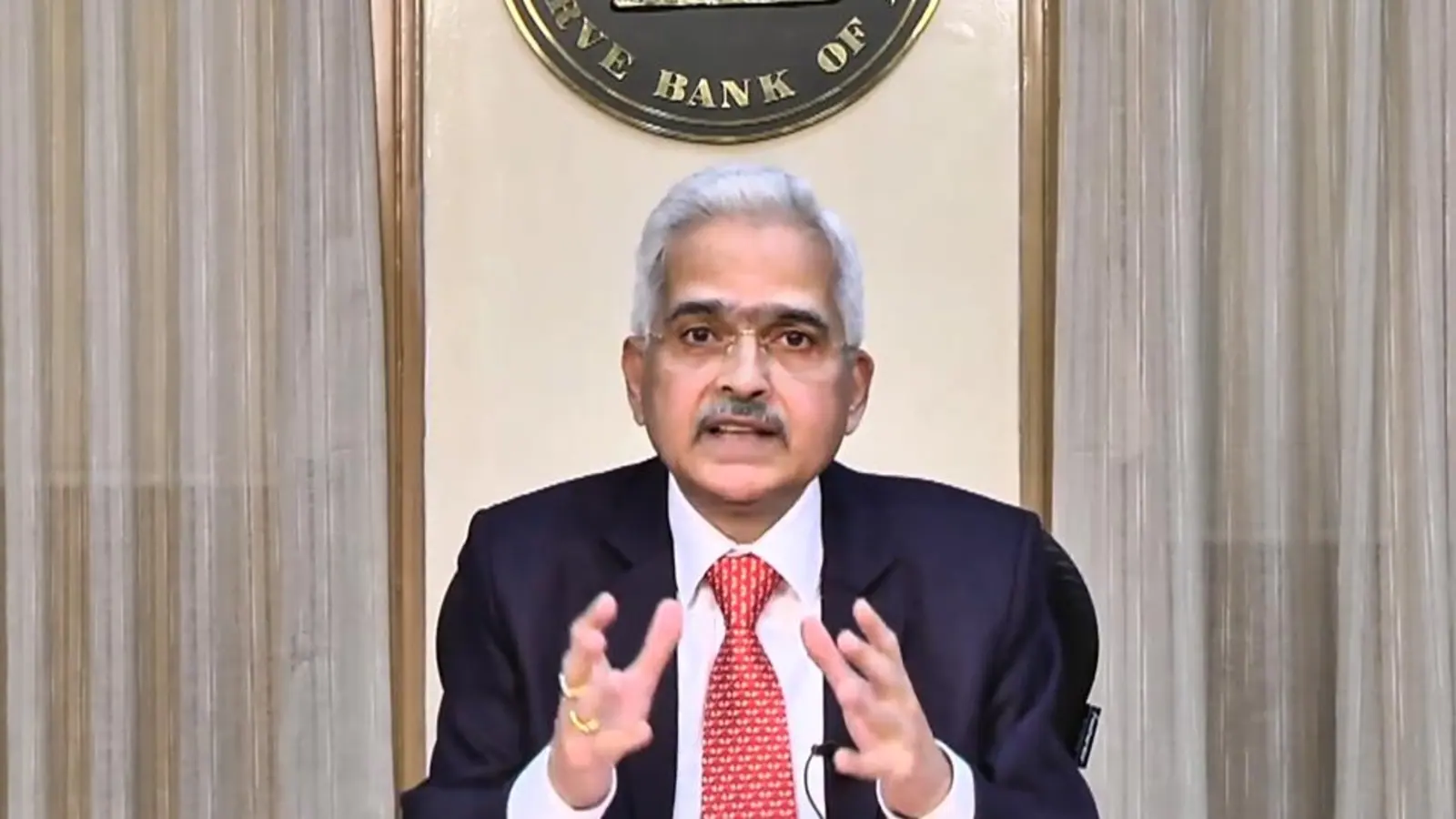

The Reserve Bank of India on Friday issued its monetary policy report and kept key lending rates – repo rate and reverse repo – unchanged at 4 per cent and 3.35 per cent, respectively. RBI governor Shaktikanta Das said the six-member Monetary Policy Committee voted unanimously to leave the rates unchanged and keep the central bank’s stance ‘accommodative’, meaning it remains conducive for easier borrowing between the RBI and other banks in the country.

READ: RBI holds key rates at record lows, ups inflation forecast

Das – delivering the first monetary policy review of FY 2022/23 – also said India’s projected real GDP is expected to be 7.2 per cent, with a high of 16.2 per cent in Q1. Quarterly projections show 6.3 per cent inflation in Q1, 5 per cent in Q2, 5.4 per cent in Q3 and 5.1 per cent in Q4, Das noted.

Here is an explainer of some of the terms used by governor Shaktikanta Das.

What is the monetary policy?

Essentially the monetary policy is a collection of financial tools and measures available with the RBI (or the central bank of any country) to safeguard and promote economic growth. While there are other ways for central banks to do this, monetary policy reviews are among the most effective.

Monetary policies basically control the overall supply of money available to commercial banks and, indirectly, to individual users and companies.

According to the RBI, the primary objective of a monetary policy is to maintain price stability while keeping in mind objective of growth. Price stability is a necessary precondition to sustainable growth, the RBI has noted on its website.

What is repo rate?

Repo rate is the interest charged by the RBI when commercial banks borrow from them by selling their securities to the central bank. Essentially it is the interest charged by the RBI when banks borrow from them – much like commercial banks charge you interest for a car loan or home loan.

What is reverse repo rate?

As the name suggests, this is the interest rate the RBI pays to commercial banks when they store excess cash reserves with the central bank. This is used by the RBI to control the flow of cash money in the economy.

Basically this allows the RBI to ‘mop up’ excess cash money by making it more profitable for commercial banks to store cash reserves with the central bank.

Why is repo rate usually higher than reverse repo?

Like all banks, the RBI must earn more than it pays – this means the interest it charges the commercial banks is higher than the interest it pays out to the same banks.

READ: RBI keeps key lending rates unchanged, real GDP growth projected at 7.2%

Why are repo and reverse repo rates key?

They are essential to boosting credit and investments by businesses as the Indian economy pushes to emerge from the twin blows of the pandemic and the conflict in Ukraine. The Monetary Policy Committee’s review of the economy is key to markets and general business sentiment.

The RBI uses repo and reverse repo rates to gently nudge interest rates offered throughout the banking sector and, therefore, the broader economy.

For example, by reducing the repo rate (the rate at which borrows from commercial banks) it can encourage economic activity because it allows your bank to reduce the interest rate on business loans, car loans, home loans, etc., as well as savings interest rate.

This encourages people to spend money because they see lesser value in keeping cash in the banks.

Reverse repo does the opposite – by incentivising commercial banks to store its reserves the RBI ‘mops up’ cash and increases interest rates for you. This encourages people to store rather than spend, and reduces the amount of cash in circulation and, thereby, also controls inflation.

[ad_2]

Source link