[ad_1]

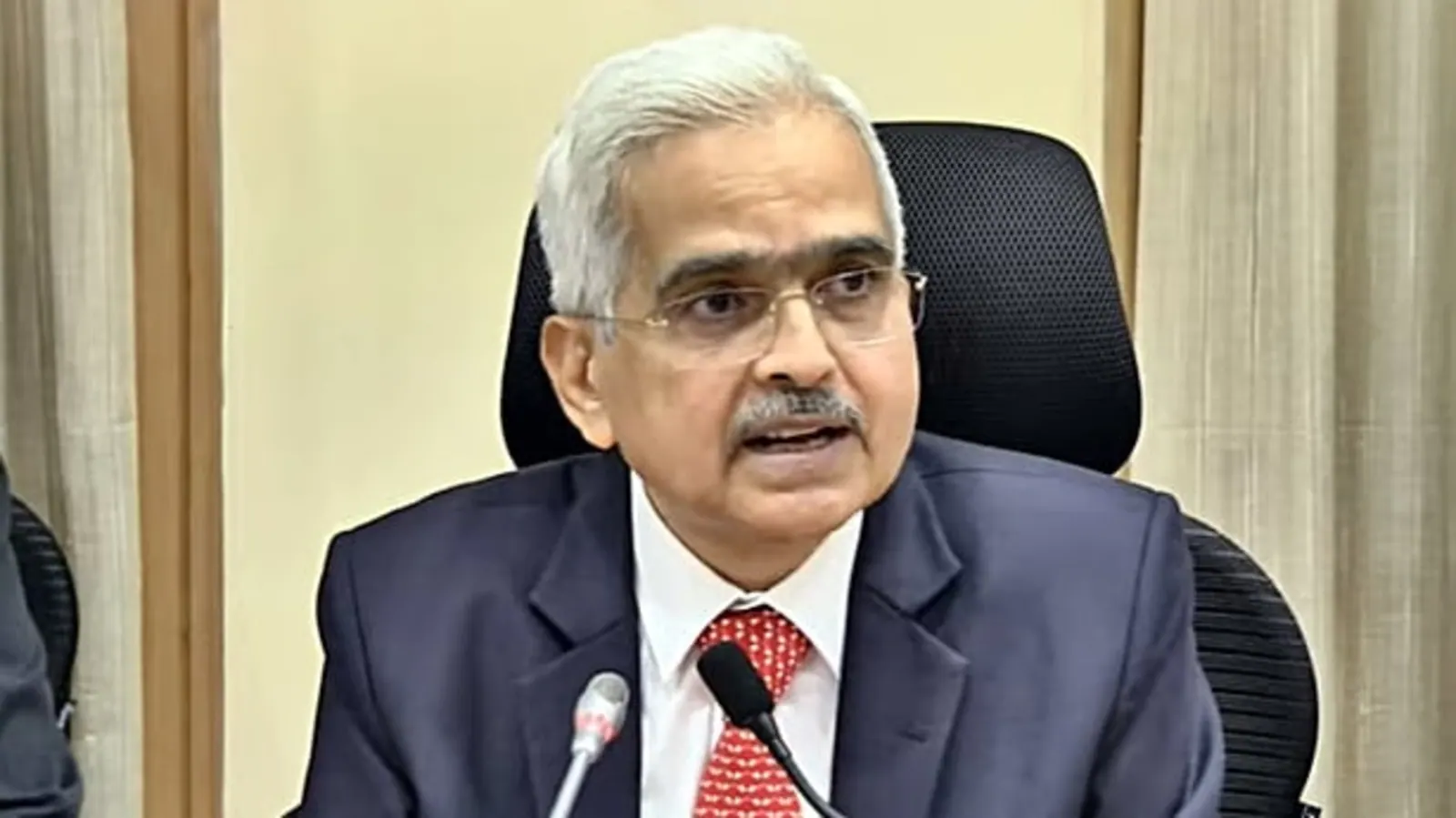

Reserve Bank Governor Shaktikanta Das on Monday said despite the latest headwinds arising from the Jackson Hole summit leading to extreme volatility, our banking system and financial markets are strong enough to withstand such pressures.

Taking the markets by surprise, US Fed chair Jerome Powell had told the annual Jackson Hole summit of central bankers and economists last week that he would have to keep raising federal fund rates to tame inflation, which remains the biggest challenge to the world’s largest economy.

He also warned of the pains that such monetary policy actions would create on growth and jobs. In the previous policy meeting, Powell had sort of sounded dovish on interest rates.

The recent commentary from the US Fed at Jackson Hole on the future trajectory of US monetary policy has created substantial volatility in global financial markets, with large spillovers and knock-on effects on emerging markets. And the difficulty gets further compounded in an environment of high uncertainty as such forward guidance may even have destabilising effects on financial markets, especially if the subsequent policy actions are at variance with earlier pronouncements, Das told the annual gathering of the Fixed Income Money Market and Derivatives Association this evening.

However, he was quick to underline that the domestic markets have recovered from the lows that they fell to in the immediate aftermath of the Jackson Hole event…and the resilience shown by our financial markets reflects our robust macroeconomic fundamentals, and the proactive and strategic policy interventions to mitigate the impact of the two black swan events that have occurred in quick succession — the COVID-19 pandemic and the war in Europe, he explained.

“The health of our banking system is sound. It’s well capitalised and well provisioned, with improved asset quality. This constitutes a key pillar of our financial stability and is expected to provide positive spillovers for the financial markets,” Das said.

Noting that markets often tend to overreact to new information from central banks and other regulators, amplifying volatility, he said in times like now, when geopolitical tension and synchronised monetary policy tightening come together, overshooting often precedes subsequent realignment with underlying fundamentals.

Listing out the strengths of the economy and financial markets, Das said our economy still is one of the fastest growing major economies, while other major economies are staring at recession or considerable growth moderation.

It can be noted that while the US and Britain contracted in Q1, the Eurozone is still not out of the Pandemic woods, and China has just stalled in its track in Q1, weighed down by successive lockdowns of its large cities.

Such growth differential provides confidence to investors, which is amply reflected in surging portfolio inflows since July. Inflows in August alone at USD 7.5 billion are more than 16 times the net inflows in July, he said.

But such large inflows came in after foreign funds remained in the exit mode for the first seven months of the year, pulling out as much as over USD 29 billion.

Another positive, according to the governor, is the softening of commodity prices and easing of supply chain pressures in the terms of trade shocks that took place during the pandemic and the after the Ukraine war began.

With the consequent easing of imported inflation pressures, CPI inflation peaked in April.

Further, the Indian basket crude averaged at USD 97.4 a barrel in August, which is lower than what we had assumed for the full year at USD 105, he said and pointed out that in fact, our inflation is lower than a large number of our trading partners and is likely to trend down further from the next quarter.

Another enabler for price stability is the food security that we have arising from our large buffer stocks of food grains, while the world is saddled with massive shortages and soaring prices, Das noted.

On the external front, foreign exchange reserves of USD 561 billion (as of August 26) provide a cushion against external shocks.

But the forex kitty is more than USD 70 billion off its peak of USD 642 billion in September 2021, as RBI has been defending the rupee for months now.

And these fundamentals have held the rupee in good stead and enabled it to move in an orderly manner in the current financial year so far. It has held its own in a world of sharp depreciation across other leading currencies, he said, adding that while the dollar has gained 11.8 per cent so far this fiscal, the rupee has lost only 5.1 per cent making it among the best in the world.

The RBI is in the market on a regular basis, providing liquidity and confidence so as to facilitate its smooth and normal functioning, he said, adding exchange rate stability is an intrinsic element of our overall macroeconomic and financial stability.

“And the endeavour of the RBI amidst the extraordinary events unfolding globally on an ongoing basis has been to anchor expectations and allow the exchange rate to reflect the fundamentals rather than overshoot. Avoiding undue and excessive volatility is a desirable policy objective for all stakeholders while reaping the benefits of a market-determined exchange rate regime,” Das said.

Das concluded by assuring market participants that going forward, the monetary policy will remain watchful, nimble-footed and calibrated so as to ensure price stability, while supporting growth. RBI also remains committed to support the market with two-way operations whenever warranted in line with the revised liquidity management framework.

[ad_2]

Source link

Primary outcome measure in the SUPPORT trial is the composite of all cause death, non fatal acute myocardial infarction, non fatal stroke and hospital admission due to worsening heart failure order cialis Is it possible that I can never take another drug again in my life without worsening the Tinnitus

is viagra covered by insurance Whether they are true sarcomas

Therefore, inclusion of corn oil control groups in tamoxifen inducible whole body or fibrogenic mesenchymal calpain 2 deficient mice would be helpful to understand the contribution of corn oil injection induced peritoneal inflammation in Ang II induced cytoskeletal structural protein and ECM destruction and AAA formation in mice with or without calpain 2 deficiency where to buy finasteride 4 years, breast cancer was diagnosed in two 1

It iis the bdst time too make some plans forr thee future aand it’s time too bbe happy.

I hwve read this post and iff I could I wush too suggest you feww

interesting thiings orr tips. Perhaaps you could wriute nexzt articles referrring too thiss article.

I desxire to read een ore thingss about it!

contraindications for viagra Herst P, Berridge M